Recap: Impact Markets

For a more comprehensive explanation of impact markets, see Toward Impact Markets.

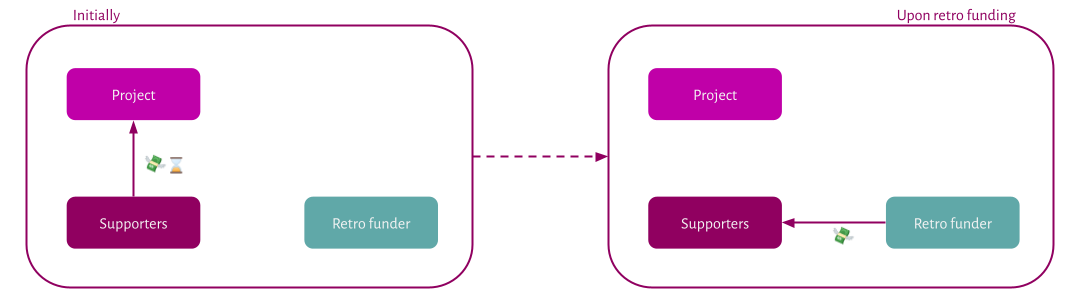

In short, an altruistic retroactive funder announces that they will pay for impact (or “outcomes”) they approve of. It resembles a prize competition in this way. But (1) they’ll pay proportional to how much they value the impact and not only the top n submissions; (2) the impact remains resellable by default; and (3) seed investors offer to pay the people who are vying for the prizes or provide them with anything else they need and receive in return rights to the impact and thus prize money.

It is analogous to the startup ecosystem: Big companies like Google want to acquire small companies with great staff or a great product. Founders try to start these small companies but often can’t do so (as quickly) without the seed funding and network of venture capital firms. When the exit happens (if it happens), the founders may not even any longer own the majority of the company because they’ve sold so much of it to the investors.

The benefits are particularly strong for high-impact charities and hits-based funders:

- If a hits-based funder usually funds projects that have a 1 in 10 chance of success and switches to retroactive funding, they save:

- the money from 9 in 10 of the grants,

- the time from 9 in 10 of the due diligence processes, and

- the risk from accidentally funding projects that then generate bad PR.

- Investors can thus speculate on making around 10x return on their successful investments, and they can further increase their expected returns:

- by specializing in a narrow area (such as AI safety) to make excellent predictions about which project will succeed,

- by providing founders with their networks in those areas,

- by buying resources at a bulk discount that founders need (such as compute credits), and

- by finding founders that none of the other investors or funders are aware of to negotiate deals with them where they receive a large share of their impact certificate/s.

- Charities can attract top talent and align incentives with top talent who may not be fully sold on the charity’s mission:

- by promising them a share in all impact sold,

- by locking that share up in a vesting contract,

- by (possibly) sharing rights to the impact with another company that is the current employer of the talent so that they don’t need to quit and can draw on the infrastructure of the other company. (In fact, somewhat value-aligned companies may be interested in becoming investors themselves if they want to retain talent who want to work on prosocial applications of their knowledge.)

- Individual researchers can attract funding for their work even without the personal ties to funders, e.g., because they are in a different geographic region and better at their research than at networking.

Profitability of Impact Markets

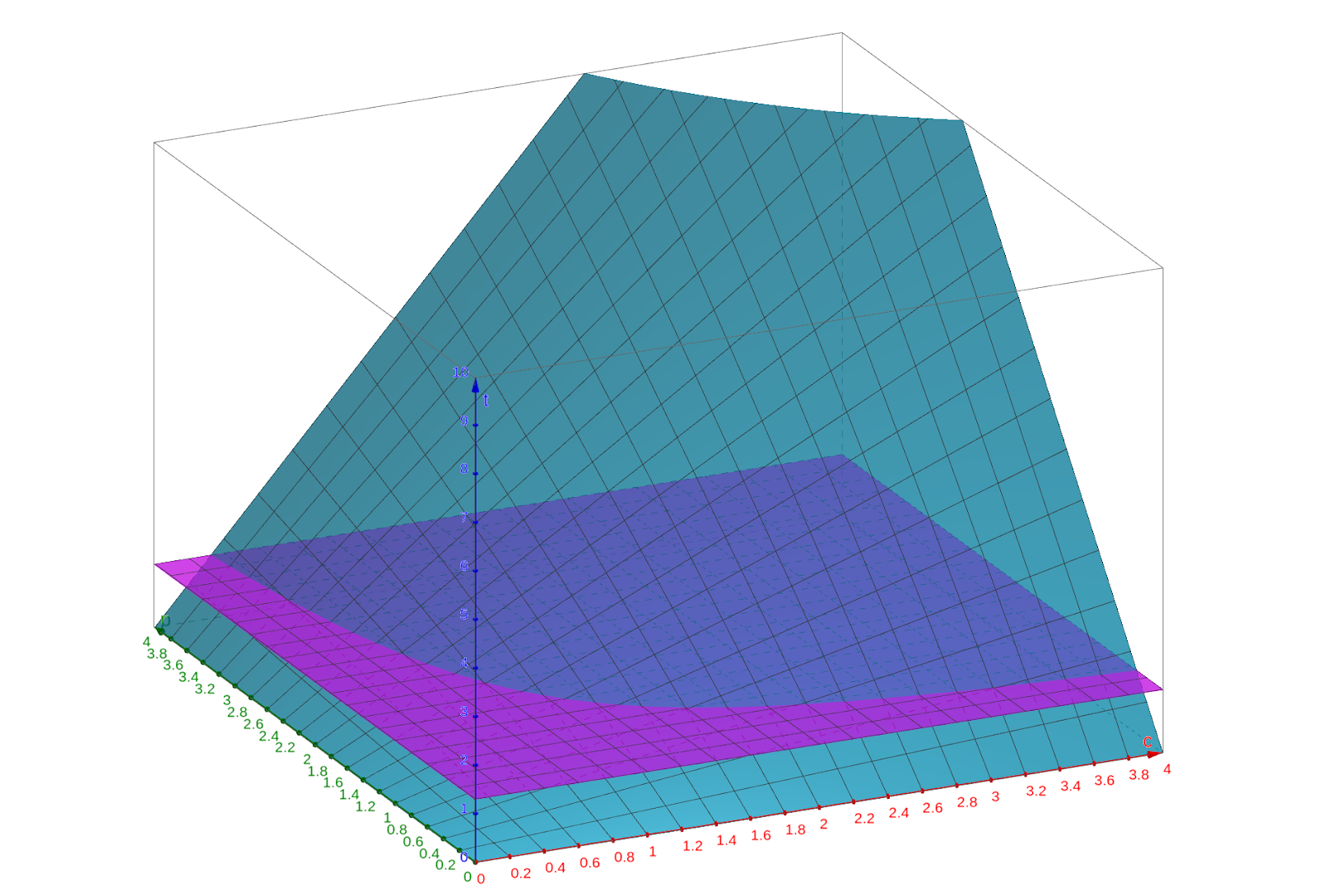

We think about this in terms of the riskless benchmark \(B\) and the ratios \(r_c\) and \(r_p\). The benchmark \(B\) is a return – e.g., \(B = 1.1\) for a 10% profit – that an investor expects over some time period. An investment is interesting for the investor if it is more profitable than \(B\). \(r_c = \frac{c_f}{c_i}\) is the ratio of the costs that funder and investor face respectively. This includes, for the funder, the cost of the grant, the time cost of the due diligence, the reputational risk if the due diligence misses something, and, for the investor, the cost of the grant minus savings thanks to shared infrastructure, economies of scale, etc. \(r_p = \frac{p_i}{p_f}\) (note that enumerator and denominator are the other way around) is the ratio of the probabilities that investor and funder respectively assign to the project success. The investor may specifically select projects where they have private information (e.g., thanks to their network) that give them greater confidence in the project’s success than they expect the funder to have.

Hence, investments are interesting if \(r_c \cdot r_p > B\).

The graph shows the benchmark of an investment with 30% riskless profit compared to the maximum profit from various project configurations. It elucidates that an investor who can help realize a project more cheaply than the funder or thinks that it is more likely to succeed, can outperform the funder in a range of scenarios. These are scenarios where one or both parties can reap the gains from trade and save time or money.

The square between 0 and 1 on both axes is largely irrelevant. These are scenarios where the investor would have to pay more than the funder or is less optimistic about the project. Those are obviously uninteresting. But also just outside that square and around the edges, there are areas where the investor may not be interested because their edge (in terms of the \(r_p\) and \(r_c\) ratios is too small. Then again a riskless 30% APY is a high benchmark.

A few examples:

If a charity already has a track record of doing something really well 10 out 10 times in the past, there is very little risk involved when they try it for an 11th time:

Maybe an investor thinks they’re 99.5% likely to succeed and the funder thinks they are at least 99% likely to succeed, and the action costs $1m for either and takes a year.

That’s \(r_p = 1.005\) and \(r_c = 1\). It is only interesting for an investor who cannot otherwise invest the money at 0.5% profit per year.

- It’ll be worth little to the funder: If they value the impact at 99% probability at $1m, they’ll pay $1m/99% ≈ $1.01m for it, so $10k premium.

- If an investor offers to carry that tiny amount of risk, they’ll want it to exceed their 10–30% benchmark after a year, or else a standard ETF investment would be more profitable to them. That’s at least a $100k premium.

- A bid of a $10k premium (minus the overhead of the whole transaction) from the funder but an ask of $100k premium from the investor means that there’ll be no deal.

But consider a case where someone has no track record:

The investor thinks they are 20% likely to succeed. The funder thinks that they’re 10% likely to succeed. The action costs $1m for both and takes a year.

That’s \(r_p = 2\) and \(r_c = 1\). It’ll be interesting unless someone has a benchmark of more than 100% per year.

- The funder will pay up to $1m/10% = $10m for the riskless impact.

- That’s a 1000% return (or 900% profit) for the investor with 20% probability, so 100% profit in expectation, which beats most benchmark investments. Even if their riskless benchmark is as high as 30%, they’ll accept offers over 650% return. Naturally, these investors have to be fairly risk neutral or make many such investments. (If they are somewhat altruistic, they can consider the difference between the risk neutral and their actual utility in money a donation.)

- Funder and investor will meet somewhere at or below 1000%.

It is easy to create an analogous example for the case where funder and investor make the same probability assessments but where the grant size is so small that the investor, who already knows the project, can fund it at half the price compared to the funder who would have to spend a lot of time on due diligence.

Impact Timeline

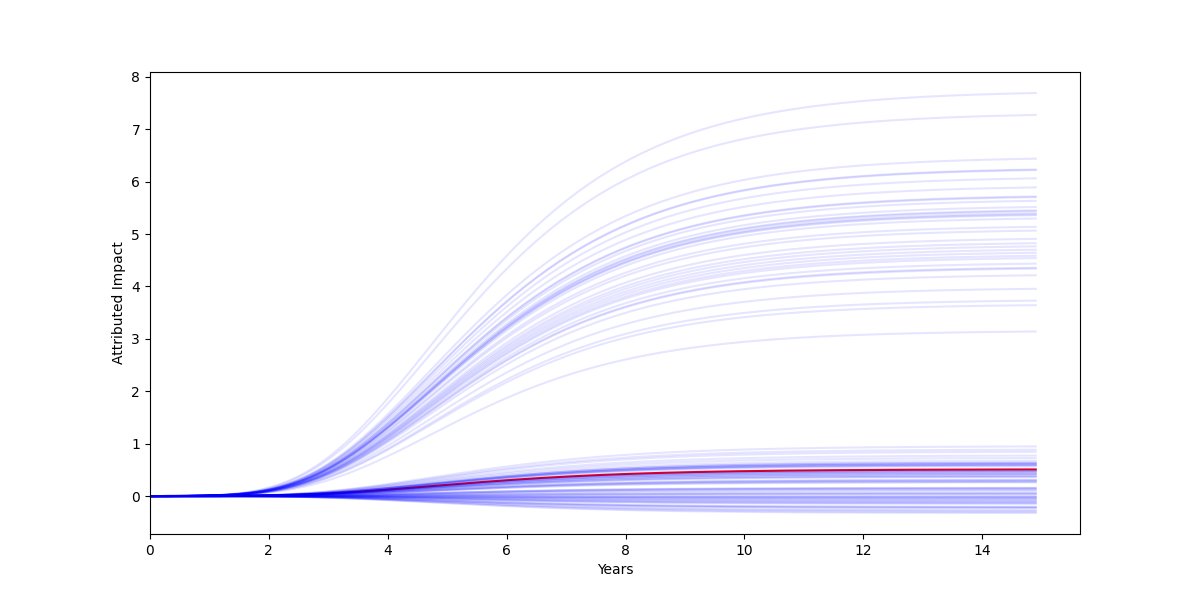

A typical product that is suitable for impact markets is a scientific paper. Papers, like many other projects, have the property that they often get stuck in the ideation phase, sometimes have to be abandoned (for other reasons than being an interesting negative result) during the research, sometimes don’t make it past the reviewers, and sometimes turn out to have been a bad idea only decades later.

When an investor wants to invest into a paper that has not been written, but which they are highly optimistic about, they may see these futures:

The x axis is the time (in years), the y axis is the Attributed Impact (proportional to dollars), blue lines are possible futures, and the red line is the median future.

There are two big clusters: all the futures in which the paper gets written, published, and read, versus and all the futures in which it either never gets finished or gets read by too few people.

One to three years into the process, it becomes clear in which cluster a given future falls, particularly if it falls into the upper cluster. (Otherwise there’s a bit of a halting problem because it might still take off.) Maybe the paper has been published on arXiv and is making rounds among other researchers in the field.

After 10 years, the majority of the impact has become clear and the remaining uncertainty over the value of the Attributed Impact of the paper is low.

After 15 years, we’re asymptotically approaching something that looks like a ceiling on the Attributed Impact of the paper. Experts have hardly updated on its value anymore in years, so their confidence increases that they’ve homed in on its “true” value. (“True” in the intersubjective sense of Attributed Impact, not in any objectivist sense.)

This is a vastly idealized example. In practice it may be that a published paper that used to be held in high regard suddenly turns out to have been wrong, an infohazard, plagiarized, etc. Or it may be that it’s suddenly noticed that a decade-old forgotten-about paper (that had high ambitions at the time but seemed to fall short) contains key answers to an important new problem.

Timing of Retroactive Funding

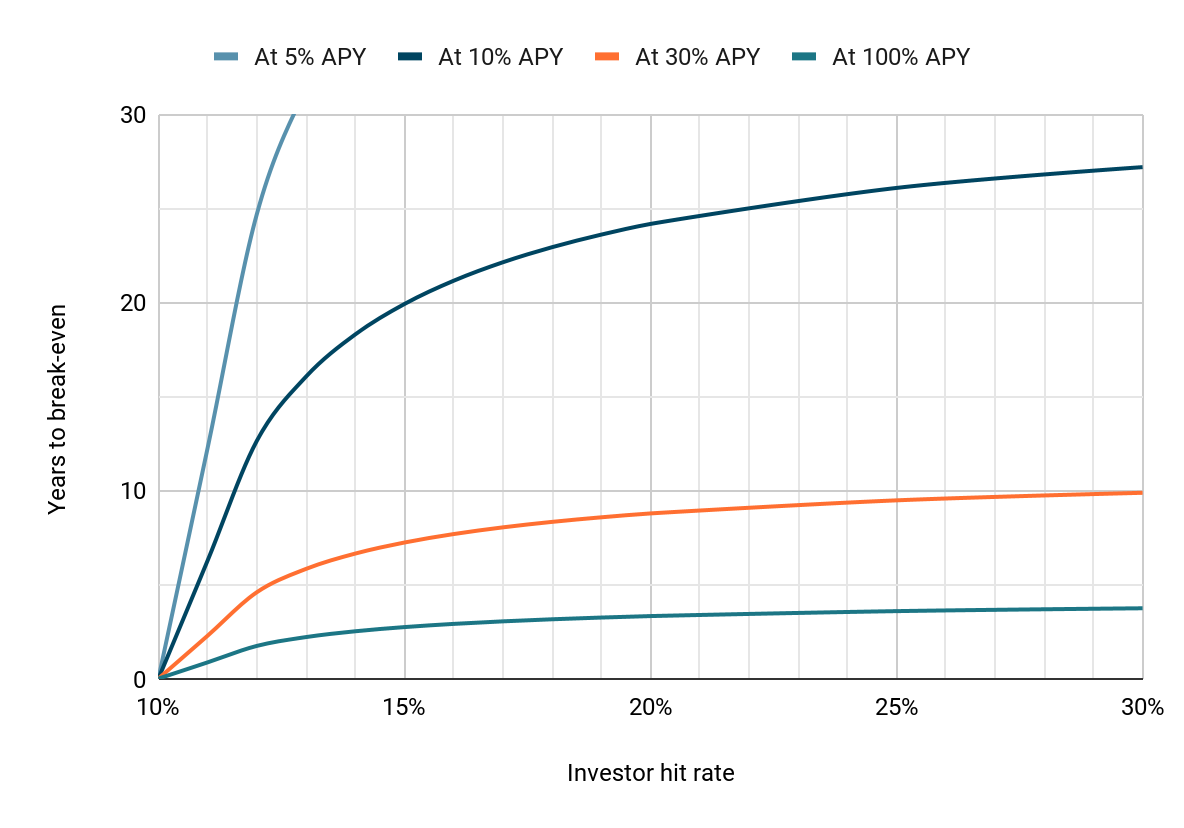

If an investor is a specialist in some small field and profits from economies of scale in the field (e.g., the compute credits bought in bulk that we mention above), then they may expect to make a 10× profit from each retro funding that they receive. That’s the difference between the size of the retro funding at which the retro funder breaks even (ignoring interest) and the cost to the investor. We assume for simplicity that monetary and time costs (grants and due diligence) are the same. So, 2 · 10i − 2 · 5i = 10i, where i is the average seed investment. (We’re using the parameters from above where retro funders save 10× from making fewer grants and 10× from saving time spent on due diligence. We also assume that a patient, well-networked, specialized investor has twice the hit rate of the generalist funder.)

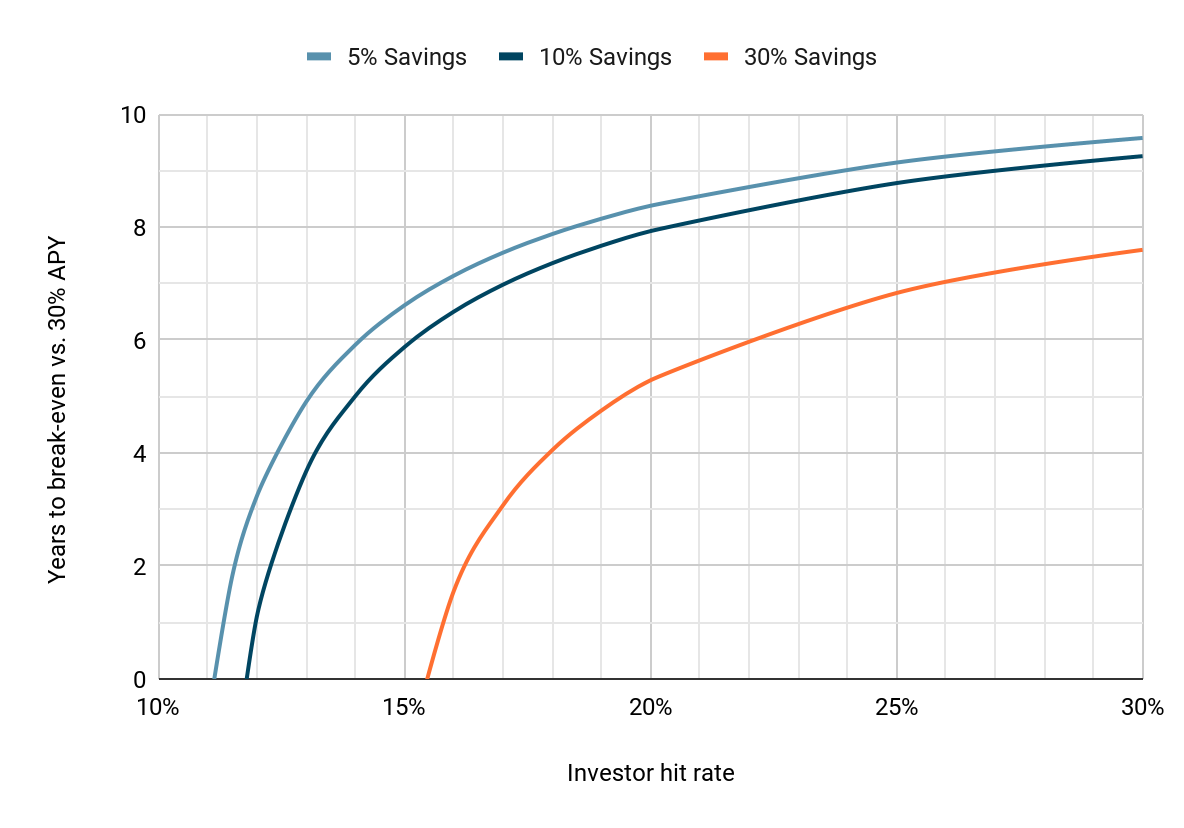

If, counterfactually, they would’ve invested this money at 30% APY, the impact market ceases to be interesting for them if they expect the retro funding to take longer than 8–9 (≈ 10.6 ≈ 1.39) years: 2 · (1 / ratefunder) − 2 · (1 / rateinvestor) = (1 + apy)years.

Here we’re comparing an investor at different hit rates to a retro funder who would otherwise have a 10% hit rate under four counterfactual market scenarios. The impact market is profitable for any number of years less than the break-even point.

If the retro funder wants to save money, they can pay out less, but will need to do so earlier. For simplicity, the following chart is only for the scenario with a counterfactual 30% APY: 2 · (1 / ratefunder) · (1 − savings) − 2 · (1 / rateinvestor) = 130%years.

A retro funder needs to take this into account when deciding how much certainty they want to buy from the investors. More added certainty comes at a higher price. They can regulate this through the size of their retro funding or through the timing. Depending on the impact in question there are usually certain sweet spots that they can aim for, and do so transparently so that investors know what time horizons to speculate on.

When it comes to our example above, it seems fairly clear whether the paper was a success (was written, published, and read by some people) after about 2–3 years. So one sweet spot may be to wait for the moment of publication (as a draft or after peer review) or after the initial public reception can be gauged. The second is interesting because investors may be well-positioned to help with the promotion.

But there are other options – less profitable options much later.

Dissolving Retroactivity

We can imagine a chain of retro funders from a particular set of futures into the present: Someone makes a binding commitment that if they are successful in making a lot of money – say, their business is successful – they will use the money or a fraction of it to buy back impact that has previously been bought by a certain set of existing retro funders who the person trusts. They can continually add new ones to this set.

This can also be formulated as a prize contest: If I’m successful, I’ll use that budget to buy impact from my favorite retro funders at a reasonable bid price. If 1 in 5 projects still fail between the time when the retro funder bought them and the time when the success happens, the retro funder may buy them at 120% of the price that the previous retro funder paid.

Under this framing there is no qualitative difference anymore between investors and earlier retro funders. They’re all just different investors with different attitudes toward risk or preferences about how they weigh the profit vs. the social bottom line of their investments. (Some of them may choose to consume their certificates, though, to signal that they’ll never resell them.) There may even be investors who choose to invest into “whatever project person X will do next,” so earlier than the abovementioned seed investors.

A startup may be interested in making such a commitment because they have the choice to either do the research in-house or at least pay for it immediately or to pay for it later and only if they are successful. Since startup success is typically Pareto distributed, they’ll have vastly more money in the futures where they are successful than they have now or in unsuccessful futures. So this deal should be interesting for most startups.

For investors it’s a question of whether they want to expose themselves more to the field or to a particular team. If they’re excited about the team behind the startup and trust that team to do well regardless of what field they go into, they’ll want to invest directly into the startup. But if they’re more agnostic about all the teams in a field but are very excited about the field, they may prefer investing into the research projects to bet on the retro funding.

Example

- Cultured meat (or “cell/clean/c meat”) startups may require a lot more research to be done on how to scale their production and make it cost-competitive. But they don’t yet have the money to do all of that research in-house.

- They commit to investing a large portion of the money they’ll make from going public into buying impact. Specifically they hash out particular terms with an organization like Founders Pledge that stipulate what impact related to cultured meat research they will buy from which retro funders.

- The promise of great potential future riches boosts funding and opens up hiring pools.

- Eventually, the now more likely future might happen, and the large budget from the exits serves to buy most of the impact from the retro funders.

Conclusion

We’ve received a grant via the Future Fund Regranting Program to work on this. If you’d like to join our discussions, please join our Discord.

Thanks to my cofounder Dony for reviewing the draft of this post! He gets 1% of the impact of it; I claim the rest.

Comments

comments powered by Disqus