Toward Impact Markets

Enhanced prize contests to boost the efficiency of hits-based public goods funding

Summary

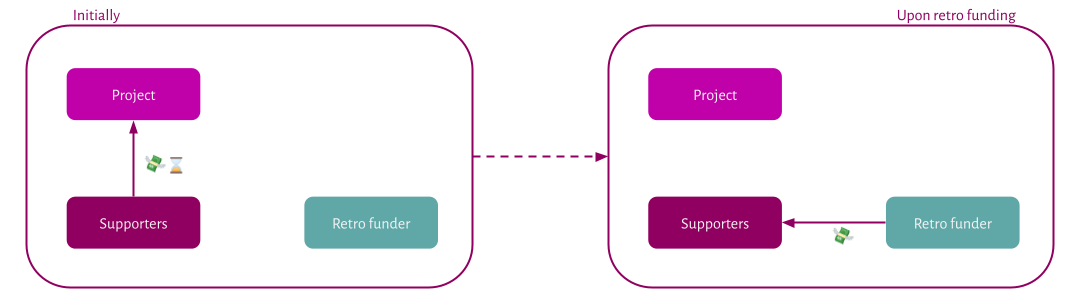

You can think of an impact market as a prize contest. There is a prize pool and an announcement that prizes will be awarded to incentivize certain contributions that the prize committee wants to see. Additionally, it’s possible for contestants to attract seed investments and collaborators to help realize their contributions in return for a promise to share the prize money.

Therefore, the backbone of the market are the prize committees, which we call retroactive funders or retro funders. They are, for example, foundations with a team of sophisticated altruistic grantmakers. They are transparent about the sorts of contributions (or impact) that they want to see and reward it when they see it. Some altruists or charities will be in a position to complete such actions without help, but others will need to fundraise or partner with others first. An impact market is where this fundraising and partnering can take place. It’s a variation on the idea of social impact bonds.

Impact markets promise to partially solve a range of pressing problems that altruists face. First and foremost, they allow grantmakers to delegate the “startup picking” aspect of their work to profit-oriented investors, and then only invest time and money in the minority of cases in which a project meets their bar for success. (See sections Retroactive Funding and Benefits.) These and other benefits can boost the efficiency of the funding allocation of hits-based funders by one or two orders of magnitude.

However, impact markets also bear a number of (1) benign risks that can cause them to fail and (2) more dangerous risks that can cause them to be harmful. (See section Risks.) We think it will be possible to address the risks in the second category, but we would like to be more certain of that. (See section Solutions.) Small-scale, sandboxed experiments among highly informed participants may help us test impact markets while limiting their risks, which is what some parties are now attempting. (See section Current Work.)

We hope that this article will give readers a chance to critique our plans and point out further risks or weaknesses in our defenses against known risks. If you would like to help, please join our Discord, comment, or contact us some other way.

Impact Markets

Our current best guess is that impact markets will take the shape of four incremental additions to existing financial markets.

Retroactive funding. First there needs to be a norm of and ideally several institutions for retroactive funding. They have a lot of responsibility for the health of the market and need to monitor it closely. We don’t think that it’s generally feasible for them to operationalize up front exactly what the impact looks like that they want to buy (say, by pointing to particular metrics) but rather want to rely on indirect normativity: Market participants can read about them and talk to them and try to understand their values. Ideally there are many retro funders who are all highly qualified and responsible and who are getting more numerous over time and whose capital increases. Some of these retro funders may have been started with the explicit goal to incentivize more retro funders by retro-funding existing retro funders. (We’ll use the terms “retro funder” and “to retro-fund” as convenient short forms.)

Contracts. Anyone who founds, funds, or otherwise supports a project – a supporter – and wants to participate in its success needs to negotiate their inclusion in a contract (an impact certificate) that documents what share of the impact of the project they own. Retroactive funders will later require this proof if they are interested in buying the impact from the supporter. (Whether it’s possible to produce such proof retroactively, when it is needed, depends on the specifics of the case.)

Auction platform. Seed investors are probably hesitant to invest into impact if they have to fear that it’ll be hard or take a long time for them to find a buyer for it. An auction platform can streamline the interaction between the buyers and the sellers of impact.

Impact stock and derivatives. Finally, at some later date, charities (incorporated as, e.g., public benefit corporations) may decide to create their own stock. Alternatively, some third parties may create derivatives that track the market capitalization of all impact certificates of one charity. These will make some forms of investment easier, and charities could use them for mission hedging. Seed investments no longer need to go through each impact certificate once a charity has stock.

Notes

This whole document culminates in a particular definition of the Impact Attribution Norm (formerly Attributed Impact). All mentions of the “Impact Attribution Norm” and just “impact” refer, by default, to the Impact Attribution Norm according to that definition. Verbs such as “liking” or “valuing” impact also by default refer to valuing the Impact Attribution Norm of an action.

What we call “charity” is a charity in spirit but may be an Impact DAO or an entity incorporated as for-profit if that is necessary. Examples: Against Malaria Foundation, Wave, Protocol Labs.

What we call a “project” is a precisely defined undertaking of, for example, a charity. Examples: one distribution of long-lasting insecticide-treated bednets, an epic in a software development process, a conference.

We want impact markets to be interesting for (1) altruistic consequentialists and (2) profit-oriented capitalists. (Most people are a bit of both.) If it ends up being useful for collectors too, all the better, but we want impact markets to work regardless of whether collectors get interested in them.

Retroactive Funding

Retroactive funders benefit in various ways. This follow-up article quantifies the benefits and uses a clearer example. (Here’s another attempt that indicates that impact markets may be 60–11,000 times as efficient as prospective funding, or 500 times in the median case.)

Reduced Uncertainty

Retroactive funders only fund projects that have achieved a certain degree of success.

Projects usually go through two phases, a phase where finding out whether it’ll be successful is a question that management experts and priorities research experts need to collaborate on and a phase where the management experts are not needed anymore.

Let’s say that the project is a proposed conference a year in the future.

In the first phase the project can fail because the team behind it splits up, because the team procrastinates until all venues are booked, or because a pandemic strikes. It can also fail because the attendees come away excited about Homeopaths Without Borders or because one attendee took out vacation days to attend and their replacement accidentally triggered a Dead Hand mechanism.

The second phase starts when the conference is over, the venue is cleaned, and the feedback from the attendees is in. In this second phase all the uncertainty concerning the team, their procrastination, and the pandemic is gone. What remains is just the second type of uncertainty. (Or some part of it since the clumsy replacement has probably returned to their accustomed job away from the Dead Hand mechanism.) The uncertainty at this stage is strictly lower than the uncertainty during the first phase.

Let’s suppose that a retroactive funder has the requirement on a conference that it must’ve happened, that not too many attendees died from Covid, and that the feedback was at least 90% positive. Let’s further suppose that they would have to spend one day per proposed future conference to assess whether the team behind it will reach that bar, and that then they’ll be right in 1 in 5 cases.

Not having to do all of this means saving 5 times 1 day of work per successful conference for the evaluation and keeping the grant money for longer. So even if they buy the impact of the 1 in 5 successful conferences at 5× the price, they still make a profit, altruistically speaking.

The lower the probability that they assign to the projects’ success, the greater the efficiency improvement that impact markets provide.

Reduced Evaluation Time

Let’s suppose that the funder supports a lot of conferences that follow roughly the same pattern, so that can be said to implement the same intervention, and that the funder has invested enough time up front to now be quite confident in the value of the intervention.

If the 5 days for the team evaluation are half the time that they would, counterfactually, spend per project (counting the up-front investment into finding the intervention), then they can buy the successful conferences at (2 × 5)× the price of the counterfactual grant and still save money. (The factor 5 is from the subsection above.)

Longer Market Exposure

Since they invest later, they can keep their money invested in yield-generating assets for longer. In most cases this will have a small influence, say, 1.1× per year over one or two years.

Earning a Double Bottom Line

But there are even more benefits once impact markets are better established. Some retroactive funders may be quite conservative with their investments, so that they don’t think that their retroactively purchased impact certificates are (in impact terms) hundreds of times more valuable than the average impact certificate that gets purchased by other retroactive funders. These retroactive funders may be interested in doubling as a speculator in other parts of the impact market.

Usually they’d have to park their money for a few years, decades, or centuries in classic stocks, bonds, or ETFs, which generate comparatively little impact just to maintain their liquidity and thus option value. With impact markets that becomes unnecessary as they can put money in charities (essentially becoming investors too) and then take it out again when they want to use it for their retroactive funding.

As retroactive funders themselves they may also have the expertise to predict what other retroactive funders will want to buy, so that they can be among the most successful investors on the market. But we’d still think that the social bottom line will do the heavy lifting in that portfolio, so that it’s probably not so attractive for retroactive funders who think that an actual extra dollar for their retroactive funding is worth a lot more than a dollar to one of another retroactive funder’s favorite charities. For example, it might be that they estimate that their monetary profits will shrink by 1 percentage point but that the social bottom line will be similar to what the Against Malaria Foundation would have achieved with ten times that money. A GiveWell-type funder would be excited about that investment opportunity while a donor who typically supports organizations like MIRI would want to avoid it.

Finally, retroactive funders may burn their shares in impact certificates if speculators start avoiding them because they fear that the supply is too great. But if that is not a worry, other future retroactive funders may also just buy shares from earlier retroactive funders in a never-ending chain of retroactive funding. Such a chain will also signal that the retroactive funding is likely to only ever increase, which would boost long-term investment into impact certificates.

The gains from this parking are hard to pin down. The worst-case is close to 1× since it’s optional and funders won’t do it if it’s not useful for them. In the other direction it’s probably capped at around 20× since retroactive funding would not be attractive in worlds in which seed funding is (still) that effective even on the margin.

Spotting Blindspots for Funding Opportunities

If the space is big with hundreds of promising charities with dozens of certificates each at any given time, then funders may be overwhelmed and miss great retro-funding opportunities if they are outside their social circles, in another country and language, or even just very unusual. A market made up of speculators from many different industries and countries may be better at recognizing such niche opportunities than any one funder. They will also be incentivized to make sure that the funder knows about them.

Conversely, retro funders need to be wary of the temptation to ignore unpopular impact certificates. Rewarding the sorts of speculators who are smart enough to notice great funding opportunities that no one else notices is exactly the sort of mechanism that makes impact markets valuable for prioritization.

Impact Certificates

Impact certificates, in our model, are contracts that regulate how to delimit and distribute some unit of change to the supply of a public good. (See below for the Impact Attribution Norm that refines this “change to the supply of a public good.”) Owen Cotton-Barratt and I plan to publish a set of rules that will provide more clarity here. (You can find a sneak peek in our Funding the Commons talk.) They aim to smooth out some initial friction that a marketplace for impact certificates may face. We’ll summarize them briefly in the following.

The guiding metaphor. A winery is typically credited with producing wine (which corresponds to impact). This assumes that employees, letters of the land, states, ancestors, meteorologists, insects, et al. forfeit their claim to the wine one way or another, either by custom or through a contract. Wine can flow freely or evaporate, but it can also be bottled and sold. (The full bottle corresponds to an impact certificate.) The bottling, in turn, can be undone, which is usually followed by the consumption of the wine. That consumption, we assume, is final.

This metaphor should give a rough overview of the spirit of the rules.

The rules propose that impact certificates be:

as clear and concrete as possible, and

issued only by all those actors collectively who own classic legal rights in that which created the impact.

They also recommend that the market system make them:

consumable in the sense that one can permanently reverse the issue, and

incremental in the sense that they don’t require changes to existing financial markets.

Generally, we think that markets may well home in on these norms over time by themselves, but we’re currently in a good position to prevent all the frictions that would come with that. We think that in particular the first two rules are crucial. We’re more on the fence about whether rules 3 and 4 are really needed.

The rest is commentary:

The first two rules jointly limit the kinds of outputs that can be bottled up in impact certificates. The limits are not hard, but greater ambiguity will make it harder to find buyers for an impact certificate: Buyers of overly vague impact certificates may make losses if others later sell impact certificates that seem to substantially overlap. No one will quite know who owns the overlapping bits, and bid prices will drop. These buyers will later take good care not to buy overly vague certificates.

Ambiguity can have two sources: confusion over what is being sold and confusion over who (else) might make claims to that which is being sold. We therefore advise issuers of impact certificates to word them carefully and to make contracts in writing with whoever might make a claim on the impact. Note that such contracts needn’t specify a concrete fractional allocation but can also specify an algorithm (such as SourceCred) that is to be used to determine the allocation at the time of the issue.

Eventually, we imagine, aggregator and auditor firms will emerge that are independent of any issuers. Aggregators will compile all information on all impact certificates that have ever been issued on any market so that duplicates can be exposed. Issuers can then get audits to prove to buyers that they are honest and are not trying to double-spend their impact. (For example, someone might first sell their impact from “A fundraiser for Rethink Priorities,” and later sell their impact from “A fundraiser at a vertical farming expo” when really those are about one and the same fundraiser.)

Examples. A good definition may sound broadly like, “Within the 264th year of the era of Aelius Antoninus, I, Hypatia, will ghost-write and publish a paper on behalf of Ada Lovelace that proves (once she is born) that Vingean reflection is possible. I’m selling half of the impact. The other half will belong to Ms. Lovelace. There are no funders outside the market, and there are no conflicts of interest to disclose. In fact, our interests will be similar.”

(Or with reduced specificity: “Within the year N, I, Person A, will publish a paper that proves X, coauthored with Person B. I’m selling half of the impact. The other half belongs to Person B. There are no funders outside the market, and there are no conflicts of interest to disclose.”)

A paper has a clear owner, there are no funders who don’t participate in the market (including Hypatia herself), it is clear what she’ll do, how long it will take, and that afterwards the paper will be public, and it is clear that the uncertainty over the deeper merits of the work will take many centuries to be resolved. (Ada Lovelace lived about 1,400 years after Hypatia.) All this certainty and uncertainty can be priced in by the market.

A middling definition may sound like, “I, Eve, will distribute 1,000 copies of the attached Vegan Outreach leaflet at Barbican Station in London between April 1 and August 1, 2022. Vegan Outreach has waived all claims on the impact. I will sell 90% of the impact and retain 10% to appease anyone who has switched to lower-suffering behaviors in response to the leaflet but is not content to yield all of their impact to me.”

This definition is highly concrete but there is no clear concept of ownership or rights or responsibility to ground it in. As a result, some of Eve’s newly made vegans who have started to go leafleting themselves may want to sell their impact from their own leafleting. The valuation of Eve’s certificate would have to be enormous to appease them all with just 10% of it. Speculators should price in that there’s a lot of fuzziness here about how much of the impact is owned by who.

A really bad definition is something like, “I, Hancock, will use my superpowers to do something for animal rights.” It is vague in almost all the ways it can be vague. There is a broad idea of a strategy in there, but speculators will have no idea whether they should price it like a corporate campaign or like leafleting. Worse, the definition also leaves the door open to very harmful activities, so that, regardless of the actual outcomes, the Impact Attribution Norm is likely negative. A less extreme version of this is a hypothetical impact certificate for a whole organization that is still active or the whole life of a live person. Any prediction as to how these may change their strategies over the coming decades will have high variance so that the Impact Attribution Norm will almost inevitably be low.

The third rule, the consumption mechanism, allows certificate owners to influence prices by verifiably signaling that they will never sell the certificate. Possible tax-exemptions could be tied to consumption, which may be a minor concern for most investors, but some may invest through a legal entity that can only make tax-exempt grants. The consumption mechanism has also been called “dedication” and “burn.” We’re not convinced that this mechanism is necessary at first, but time will tell. One indicator that it is necessary will be if investors don’t expect impact certificates to be sufficiently deflationary or are worried that retro funders with large holdings might suddenly sell out of their positions.

Tax exemption. Note that some organizations in the crypto space seem to function like (our phrasing) “optional donor advised funds” in that they have tax exemptions in various countries and can write donation receipts but will only do so if the donor chooses to donate the money, which they don’t have to do. A retro funder could interact with the market through such an entity. If they choose to resell their impact certificates, they will not receive a donation receipt, but when they choose to burn their certificate, they get it. The donation receipt will of course then be from that intermediary rather than from the charity that actually received the money.

The fourth rule aims to allay worries that impact markets, if successful, will cause revolutionary changes to existing allocation mechanisms. Avoiding such changes avoids opposition, which should make it much easier to institute impact markets. Conversely, even fervent supporters of impact markets may find proposals unrealistic that require changes to existing, established markets.

Impact Market Participants

The key idea behind impact markets is that we want to reward supporters (such as founders, investors, and advisors to charities) who proved a particular aptitude for predicting what interventions will later be seen as impactful by sophisticated altruists.

There are three types of fundamentals on an impact market:

Projects: These are verifiable, clearly ownable, and clearly delimited sets of actions that are detailed in an impact certificate. They benefit from:

Seed funding,

More options for aligning incentives.

Supporters: These include founders, advisors, seed funders, et al. of a charity. Everyone who negotiates a share in the impact certificate. We also use the terms investor and speculator for the seed funders. They benefit from: 3. The seed funding of the project (founders and employees), 4. Being able to make an exit (founders and other shareholders), 5. Passive income (investors).

Retroactive funders: The backbone of the market. The funders who buy impact certificates once the projects have matured to a point where the retroactive funders are confident enough in their evaluation of the projects’ impact. They reward all supporters of a successful project generously, because they are thankful for not having to bear the risks of all the projects that fail even by their own lights. They benefit from: 6. Not carrying the risk for failing projects (5–10x monetary savings), 7. Not having to do charity evaluation (team, market, etc.) in addition to intervention evaluation (2x time savings), 8. Investing later in time (1.5x monetary savings), 9. Parking money (in the role of a speculator) where it generates a double bottom line (1–20x savings?), 10. Being able to draw on the market to notice blindspots in the in-house prioritization.

Let’s suppose the Against Malaria Foundation (AMF) wants to do a distribution of long-lasting insecticide-treated bednets with its old distribution partner Concern Universal (CU). Let’s further suppose that it wants to use impact certificates for this and not its usual funding channels.

(This is an example only. We didn’t talk to AMF or CU about any of this and don’t actually want any charities that don’t have expertise in innovative financial products to become involved so early in the process! Impact markets are probably also not suitable for such safe investments as AMF’s net distributions.)

AMF ascertains that some retroactive funders are still interested in more net distributions.

The AMF staff decide how they want to split the Impact Attribution Norm from the distribution among themselves, the legal entity AMF, all their partners, contributors, and advisors, and their funders. These decisions can be adjusted in later negotiations. (we’ll treat AMF, the legal entity, and all its staff as just “AMF” in the following to save space.)

AMF decides on the details of the auction process, that is, what fraction of the profits from each sale should go to AMF and what the minimum percentage raise is between bids.

AMF writes an impact certificate.

AMF contacts CU, negotiates their split with them, and sends them their fraction of the impact certificate. (we’ll assume here that the distribution partner has its own source of seed funding just to make its case interestingly different from AMF’s.)

AMF contacts a venture capital firm. The VC agrees to fund the distribution. They negotiate the split, and AMF sends them their fraction of the impact certificate.

A year later the distribution gets completed successfully.

A retro funder notices the successful distribution, is ecstatic, and buys fractions of the certificate from all holders. AMF has no work with this: Any holder just has to give their certificate (or a fraction thereof) to the buyer.

What we seek to demonstrate here is that impact certificates (the way we construe them) are not magic. They don’t need to be imbued with any deep meaning beyond that of any other contract.

Auction Platform

We want to create an auction platform to streamline the whole process. (You can keep up-to-date on the progress here.)

Our ideas for MVPs differ in two main ways: (1) The MVP can either emulate the classic market mechanisms where multiple shareholders co-own a project, or it can use the Harberger tax auction where the original issuer is paid from the profit of each sale, sales are forced, and fractionalizing ownership among multiple shareholders is optional; and (2) it can be aimed at a crypto audience and run on a blockchain, or it can be aimed at a non-crypto audience, not use a blockchain, and avoid monetary transfers. (Note that we use auction and market synonymously here.)

Either way, the critical mechanism is that there’s someone (a retro funder) who rewards earlier supporters (founders, funders, advisors, et al.) if they made what has turned out to be good calls.

The classic, non-Harberger auction (or market) has the advantages that:

Alignment. You can align incentives with cofounders, employees, advisors, partner organizations, et al. by giving them shares in the impact.

Seed funding. You can get investments by selling parts of the impact to early investors.

Exit. You can participate in the success of your project by keeping some fraction of the impact until the project has come to fruition (by your assessment) and only then exit. As a founder you will be unusually convinced of it (because if more people were, it would typically already exist), and by extension, you will be more optimistic about it than your investors.Hence you’ll want to retain as much of your impact as you can afford until the day has come when you have the proof that will convince the investors too.

Scaling down. You can start big projects by getting several investors who each buy smaller shares of the impact. Conversely, even smaller investors can get exposure to big projects by buying small shares in them.

The Harberger auction shares two of them even without shared ownership:

Alignment. You can align incentives with cofounders, employees, advisors, partner organizations, et al. by making separate contracts with them that they’ll receive part of the profit share. That would be similar to an ordinary participation.

Seed funding. You can get seed funding by selling all of your impact to early investors. You can set the minimum bid so that the funding is enough to bootstrap the project, but you can’t have any further fundraising rounds.

Simplicity. You don’t need to countertrade your investors once you have the seed funding. You’ll simply profit from each of their sales automatically.

With shared ownership, the Harberger auction shares all the benefits of the classic system, but in practice there will be trade-offs:

A larger issuer share (or tax) will discourage speculation because it’s subtracted from the profits of the speculator. The market will be less liquid as a result. But issuers can set an arbitrarily small share to manage that risk. Crypto exchanges seem to work well with taker fees around and slightly below 0.05%.

But a small share also means small profits. Prices can’t decrease in the Harberger auction, so the profits will be proportional to the price. (If they could decrease, they’d be proportional to the volume, and charities had an incentive to create volatility.) In the classic system, you and your collaborators may collectively manage to retain 10–30% of your impact until you exit, which you have to time such that you don’t sell too early. In the Harberger system you don’t have to worry about the timing, but you’ll all collectively only “retain” (through the tax) 0.05% unless you want to sacrifice market liquidity. Even if you choose to set the tax at 1%, that’s still 10x the cost, plus the reduced liquidity, in exchange for simplicity.

All in all, a Harberger auction with fractional ownership seems like it maximizes option value because issuers can choose to turn it into a classic auction by setting their tax to 0.

The current state is as follows:

Blockchain (web3). Our first testing ground was a smart contract on an Ethereum test net that implements an auction as described above. It does not currently support fractional impact certificates, but we think that that could be added in the form of a separate third-party smart contract. In general, a blockchain-based or web3 solution would have a number of advantages:

It makes it easy to interface with the existing web3 ecosystem around public goods funding.

The existing ecosystem is itself a great testing ground for innovative solutions because everyone is unusually knowledgeable of innovative financial tools, so we’re at less of a risk of making mistakes that would cause other people to lose money.

It allows for great scale as transactions are fast and frictionless, and, depending on the blockchain, also cheap.

It makes it easier to market the solution because users don’t need to trust us if they can read the code and there are audits.

(You can watch a demo in our talk at Funding the Commons II.)

Spreadsheet (web2). Another MVP that we have in mind is a spreadsheet (via Google Sheets) that tracks transactions between issuers, speculators, and retroactive funders (any pairwise permutations). One sheet simply records the transactions; another summarizes the transactions such that they show the latest configuration of ownership; and a third sheet displays some statistics, such as the price history, market capitalization, volume, etc. We haven’t created this spreadsheet yet, but we expect that it’ll be hard to scale for various reasons related to error-reporting and because spreadsheets get slow when there’s a lot of data in them.

Crucially, the spreadsheet would not execute the monetary transactions themselves, it would just record them. A transaction is then said to be pending when one side has entered it but the other hasn’t confirmed it. It is only considered for the statistics once both sides have confirmed it. Google Sheets allows owners to protect ranges and individual cells such that only one person can edit them, so that aspect should be fairly failsafe.

A variation on the same theme is a spreadsheet that only tracks what projects accept seed funding and what projects have been completed. All seed-funding transactions could then happen over a platform like Kickstarter or Indigogo. Once the project is completed, a retro funder can consider it and transfer their money either directly to all contributors or to the project founder so that they can forward it to all contributors.

We could test the spreadsheet solution by allowing people to use it to trade on retro funding for something very safe and easily verifiable such as EA Forum articles. One could also call this a “proportional prize pool for prescient philanthropists” because they are basically prizes for people who’ve made good calls – as founders, funders, supporters, or similar – except that not only the top 3 or top 10 get prizes but almost everyone who clears some minimal bar of the retro funder and has invested enough that the prize is worth the transfer overhead.

A web2 solution like that would have a few advantages too:

It is quick to iterate on as it doesn’t require audits. It won’t handle financial transactions, and even if it did from the users’ perspective, they would really be handled by a payment gateway like Datatrans.

It would not handle financial transactions, so many legal risks from those shift away from us to the users of the system, who we’ll need to warn to do their research.

It’ll be more frictionless for the sorts of users who haven’t used web3 solutions before.

Personally, we’re also a bit annoyed by people talking so much about valuing impact certificates in and of themselves like that’s important, so we like solutions that don’t obviously contain any one component that is an impact certificate. (We see an impact certificate like any other contract that we value only for the monetary or altruistic bottom line that it nets “us” – scare quotes because only the monetary bottom line is agent-relative.)

We are fairly convinced that the blockchain-based solution is going to be the culmination of our efforts one day, but we’re ambivalent over which MVP will allow us to test the market more quickly and productively. (Since we first published this document, we’ve focused on web2 and have graduated from the spreadsheet to a proper web app.)

Impact Stock and Derivatives

At later stages, we imagine that investors will find it overly complicated to use individual auctions to bid on countless projects. Some charities may also prefer to use other kinds of auctions at least for some of their projects. Plus, the trust that a project will be impactful is probably going to be tied to the team behind it, the charity, so that people, especially those who are lay people when it comes to the interventions of the charity, will prefer to invest into charities instead of individual projects.

We imagine that this can be achieved with derivatives (such as perpetual futures) that track the market capitalization of all impact certificates that a charity has issued. Alternatively, and if that is legally permissible for the charity, it could issue its own stock, which it could also use to hedge against volatility in the flow of donations that it gets through other channels.

Benefits

(We briefly covered this section in our talk at Funding the Commons II.)

We think that impact markets are most suitable for hits-based funding for individuals or young charity startups without impressive track records. This article makes this argument in greater detail. In short, reference classes of projects where success probabilities over 80–90% are common make it hard for investors to think that they have enough private information about a particular project that they will accept the low success-conditioned rewards that retro funders will pay in such cases.

The following table gives an overview – i.e. rough tendencies based on broad simplifications – of who will find which benefit to be interesting:

Benefits for Funders

Greater Maximum Scale

EA funders seem to be reaching the limits of their scale. There is a vast difference between the time investment that GiveWell and ACE have found appropriate per dollar moved to a funding opportunity compared to the time investment that hits-based funders such as the Future Fund currently find appropriate. They are probably not wrong about that given their constraints. But impact markets can change these constraints.

Specifically, if a funder currently expects 10% of their grantees to succeed (by their lights), then impact markets can allow them to scale up by 10x just thanks to the grantmaking capacity that retroactive funding conserves. They may even save money in the process. This article quantifies the benefit some more.

More Funding Opportunities

Funders are usually based in a specific location and have particular social circles. It is very costly for them to build up trust with someone outside those circles if they even learn about the person or group in the first place. That limits their access to funding opportunities to a tiny fraction of the landscape.

Much less trust is needed if founders and investors pitch already successful projects to the funders.

And the investors are already almost everywhere around the world in a variety of social circles, are expert networkers, and already have expertise in startup picking, which they can apply to charity startups.

Greater Hiring Pools

Currently grantmakers who work for funders have to be highly trusted by the people with the money, have to be experts in priorities research (or at least in understanding and applying the latest priorities research), have to have a comprehensive overview of the spaces in which they’ll do their grantmaking, and have to be great at startup picking, including all the social skill that it takes to quickly form an accurate opinion on a founder team. That’s a lot of constraints, and some of them feel intuitively anticorrelated so that it’s even harder to find people that combine all of them on a high level.

With impact markets, they only need to be trusted experts in priorities research. They don’t need to have the comprehensive overview of the spaces because countless investors are their eyes and ears. And they don’t need to be great judges of character and project-specific skill because the projects that get pitched to them already succeeded to some appreciable extent.

That should expand the hiring pool for funders many times over.

More Priorities Research

Normal investors will have incentives to publish priorities research that they do after they have invested in order to increase the price at which the certificate or certificates trade. Or they will at least publish the good bits that swayed them to invest.

Short-sellers will do the opposite and publish their exposés.

These can contain important considerations that we’ve previously missed. Failing that, they may help communicate important considerations from priorities research to a wider audience.

Parking Money

Large funders currently park their money in for-profit businesses until the growth rate from the growing wisdom of the funder (plus the low average growth rate of the businesses) drops below the growth rate of the public goods. That can take a long time and is therefore very wasteful, but it’s a necessary evil because investments into public goods are currently illiquid, so if you get them wrong, you can’t withdraw the money again. Impact markets would change that, and large funders could park their money in ETFs that comprise many big, well-established and somewhat impactful charities until they find better investment vehicles.

Benefits for Charities

Cheaper Liquidity

Charity startups and individual altruists will receive seed funding from the investors who are already in their networks and who already trust them. These may be business angels, VC, or simply room mates who have the sort of income that they can advance the rent for a year.

Aligning Incentives

Charities typically like to hire very closely value-aligned people. That means that they can pay lower salaries because everyone cares about the mission. But that doesn’t seem like the optimal state. There are people who care about the mission but also have a family to feed or a debt to repay. There are also extremely capable people who care a bit less about the mission. The charity will lose out on them.

If we now assume that the employee that the charity wants to hire has a bit of runway and can run about as much risk as an early startup employee. If they think that a retroactive funder will like the charity enough to buy its impact certificates, that employee may agree to a deal where the regular salary plus the expected value of 1% of all impact certificates adds up to more than a regular salary. If the employee cared a bit about the charity’s mission before, now they care a lot.

Incentivizing Excellence

Many funders today aim to fill or to partially fill the funding gaps of any project that clears some bar in terms of expected cost-effectiveness. So highly capable startup founders have a tradeoff to make whether they want to start a for-profit business and donate billions or whether they want to start a charity and get at most exactly as much as they need. They wouldn’t want more unless they have enough spare time to become better grantmakers than those who make grants to them. But if charities can fundraise from for-profit venture capitalists, the gulf between charities and businesses shrinks. This means entrepreneurs have a less difficult tradeoff to consider when choosing between launching a charity or a for-profit.

The quick, quantitative feedback could also by itself be motivational for founders and employees.

Risks

(We covered this section in our talk at Funding the Commons II.)

Have a look at this summary table for a quick overview.

Impact and Profit Distribution Mismatch

Investors should have strong reasons to expect that the prices of certificates will, in the limit, be proportional to the value that a Pareto-optimal compromise axiology would assign to them – that is the moral standard that is reached only when no gains from moral trade are left on the table.

But we think that is unlikely to happen by default. There is a mismatch between the probability distribution of investor profits and that of impact. Impact can go vastly negative while investor profits are capped at only losing the investment. We therefore risk that our market exacerbates negative externalities.

Standard distribution mismatch. Standard investment vehicles work the way that if you invest into a project and it fails, you lose 1 x your investment; but if you invest into a project and it’s a great success, you may make back 1,000 x your investment. So investors want to invest into many (say, 100) moonshot projects hoping that one will succeed.

When it comes to for-profits, governments are to some extent trying to limit or tax externalities, and one could also argue that if one company didn’t cause them, then another would’ve done so only briefly later. That’s cold comfort to most people, but it’s the status quo, so we would like to at least not make it worse.

Charities are more (even more) of a minefield because there is less competition, so it’s harder to argue that anything anyone does would’ve been done anyway. But at least they don’t have as much capital at their disposal. They have other motives than profit, so the externalities are not quite the same ones, but they too increase incarceration rates (Scared Straight), increase poverty (preventing contraception), reduce access to safe water (some Playpumps), maybe even exacerbate s-risks from multipolar AGI takeoffs (some AI labs), etc. These externalities will only get worse if we make them more profitable for venture capitalists to invest in.

We’re most worried about charities that have extreme upsides and extreme downsides (say, intergalactic utopia vs. suffering catastrophe). Those are the ones that will be very interesting for profit-oriented investors because of their upsides and because they don’t pay for the at least equally extreme downsides.

Most profit-oriented investors also care about countless things besides profit, but we think it makes sense to think about these risks with a security mindset and assume that there are purely profit-oriented investors out there who can move a lot of capital. Besides, most investors will not be aware of the interests of future generations millions of years from now, of invertebrates, or of beings close to our acausal trade partners.

A simplified analogy is pictured above. This first aid quiz counts correct answers only – just like the market – so if you select all answers, you get the full points even though most people would not survive such treatment for nosebleed.

This risk applies to prize contests in general, especially relatively long-running ones. We find it reassuring that prize contests have not yet ended the world, but we would like to see more historical analysis of the actual hidden (or maybe obvious) harms that have come off well-intentioned prize contests in the past.

Anthropic distribution mismatch. Moreover, if the downsides are strictly about extinction, then the investors will lose their bets in worlds in which they wouldn’t have been able to spend the money anyway.

They might regret this if they thought that their bet itself had increased the probability of losing the bet, but they’ll probably assign a low probability to that because they may, for example, reason that they merely defected in an already hopeless collective prisoners’ dilemma. Some people reason along the same lines when they argue that divestment is ineffective (something that Paul Christiano critiques): If the market is sufficiently efficient, any divestment will result in an inefficiency that will quickly be compensated by equally sized investments of others. These factors cause us to worry that investors will be likely to defect against values that are concerned with x-risks (including s-risks).

Both of these can be framed as problems of lacking moral trade because the investors defect against some futures for the benefit of others when they should’ve invested in ways that respect the interests of all futures.

Below we present a definition of the “Impact Attribution Norm” that combines earnest intention with outcome and thereby addresses the problems related to moral trade and extinction.

Moral Cooperation Failure

It is uncommon for two people to each have only one interest, and for these interests to be exact opposites. So in most cases it should be possible to find a compromise that improves the aggregate good that is achieved and, ideally, one that is as good or better than the cooperation failure for both, a Pareto-improvement.

Here are some pilfered images by Brian Tomasik from the Center on Long-Term Risk:

The caption is: “Pareto improvements for competing value systems. The two axiologies are opposed on the x-axis dimension but agree on the y-axis dimension. Axiology #2 cares more about the y-axis dimension and so is willing to accept some loss on the x-axis dimension to compensate Axiology #1.”

Caption: “Figure 2: Imputations for compromise between deep ecologists and animal welfarists, with pi = 0.5 for both sides. By “Pareto frontier” in this context, I mean the set of possible Pareto-optimal Pareto improvements relative to the (50, 50) disagreement point.”

The line labeled as “Fight” is the conflict that we would see on our markets if both parties were to fundraise for their conflicting goals and consequently burn most of their resources in a zero-sum conflict. But if they talk to each other and compromise, then they can realize outcomes that are better in aggregate (almost inevitably), and in particular outcomes on the Pareto frontier, which are directly desirable (or neutral) for both parties!

Had impact markets existed a few decades ago, there might’ve been projects that pushed for coal energy over nuclear energy. These might then have gotten a lot of funding from investors and retroactive funders who didn’t think that climate change was a significant worry. Our and future generations would then have been defected against. (Our interests would’ve been ignored because we didn’t participate in the market through retro funders.) Instead it would’ve been possible for these people to instead invest into R & D for the next generation of safer nuclear reactors, which would’ve allayed their safety concerns without exacerbating climate change.

Similarly, an animal conservation organization might want to use impact markets to fundraise for the protection of certain predator animals. They might fundraise large sums from people who are interested in the protection of that species, but they would thereby defect against the interests of the prey animals who are much more numerous and probably similarly capable of suffering. Instead they could’ve fundraised for the protection of a herbivore species that mostly eats fruit and whose members are unlikely to experience great amounts of suffering themselves throughout their lives.

Worse, the conservation charity that increases the number of predators at the expense of the prey animals may sell impact at a positive price and another charity that protects the prey animals against the predators by (say) making them infertile could also sell their impact at a positive price. Both impact certificates may have a large positive valuation when really their impact more or less cancels out! So this egregious waste of resources can even happen when both parties participate in the market in some way.

Another egregious example is terrorism. Terrorists may want to use impact markets to fundraise for their attacks. Maybe they are religiously motivated and are attacking people as a form of proselytizing with extreme prejudice. Meanwhile other groups may use the same markets to fundraise for terrorism prevention. That is again wasteful since they could instead pool their resources in open-access adversarial collaborations on questions of religion.

We think this lack of any incentive for individuals to engage in moral trade is a major risk. The distribution mismatch is, strictly speaking, a sub-risk, but that’s a bit unintuitive, and we think that both are so important that they deserve their own sections be it only for emphasis.

Finally note the difference between revealed and idealized preferences. The first step when attempting a compromise should probably not be to trade right away but, if possible, to discuss the object-level disagreement. It may be that at least one of you is simply wrong, will realize that, and will no longer be interested in the competing intervention at all. (But others might be.)

Manipulation of the Default

An attacker might first build a reputation of regularly doing exactly the sorts of things that large funders hate, such as running flash loan attacks against crypto markets or denial of service attacks against blockchains, and then skip some of these regular attacks in order to sell their impact from not attacking. This exploit is based on the ability of the attacker to change the default state of the world from one in which they don’t attack to one in which they do attack, and regularly.

This failure mode would cause impact markets to exacerbate exactly the sorts of problems we want to solve. The “Impact Attribution Norm” definition below addresses it.

One real example that sort of fits is the following anecdote that I’ve heard from a reliable source but haven’t fact-checked: When the cap & trade carbon trading system was first introduced in the EU, many polluting companies either first polluted even more or exaggerated their level of pollution so that their default level of pollution would be set higher. With the exaggerated default it was cheap for them to (seemingly) reduce their carbon emissions again, and they didn’t have to buy carbon certificates.

Similarly, one sometimes hears of stores that momentarily increase the price for a product (or just lie about the old price) and then advertise the same or a higher price as a discounted sale price.

We’re not as worried about this as we are about moral trade and, in particular, the distribution mismatch, because attackers could, in many cases, already attack funders this way. The funders just have less of a target painted onto them, figuratively speaking. Yet funders should make it clear that they will not be fooled this way, because even a failed attempt at such a ruse can do harm, as in the case of the increased pollution.

Drawbacks of Verifiability

Impact markets will probably tend toward high verifiability requirements all by themselves, but only after many buyers have been burned by investments into impact certificates that later turned out to overlap with other impact certificates and whose price dropped as a result. Prescribing a high degree of clarity from the start will hopefully avoid this friction and keep more buyers interested in impact markets. Keeping impact certificates more clearly delineated also helps to separate them from impact stock.

But there are two possible drawbacks to this. The first is related to Goodharting. Charities that have a very clear output – e.g., papers or bed nets – will have an easy time fundraising on impact markets. But charities with more fuzzy outputs – e.g., community cohesion or plan changes – may be relatively disadvantaged by the format. That could lead to a relative underinvestment of money and effort into these more fuzzy interventions. Worse, most interventions can probably easily be measured by a few proxy measures that, when optimized for, lead to terrible outcomes. That’s a case of a failure of moral trade. The Impact Attribution Norm discourages it, but overconfident issuers may still seek to sneak in the bad proxy measures that they perform excellently on.

The other drawback is that explicit contracts with collaborators may not be enough. We’re currently collaborating with many others in a range of ways. Some examples in rough order of how explicit they appear to us: collaborations between coauthors, collaborations with reviewers, collaborations with casual conversation partners, collaborations with providers of infrastructure, and collaborations with those in the past who have made it possible that we are alive today.

If the sale of an impact certificate for, say, a paper rewards only the authors, there’s a risk that other collaborators may decide that they will be rewarded better if they don’t engage with other authors anymore to fully focus on their own papers and not give away any ideas before they have published them.

This could also happen between organizations. Each may think that it has a uniquely important mission and a responsibility toward its employees, and that it may have to shut down without funding from the sale of impact certificates. Two seemingly altruistic reasons will push these organizations to withhold all sorts of resources from the other.

The solution is to talk to all collaboration partners that form a coalition and to negotiate an allocation of the returns from impact certificates that has the core property, that is that no collaborator thinks that it is in their interest to split off from the coalition.

That’s easily done among explicit collaborators such as coauthors, cofounders, or employees. Hence why the first rule requires explicit contracts between these. But in many other cases it will require acausal trade because it would be infeasible or impossible to (causally) negotiate with the collaboration partners – they may be anonymous, dead, distant, too many, or too busy. So the first rule falls short of solving this problem.

On the other hand, impact markets are likely to reduce financial scarcity, and people are less likely to behave uncooperatively when they have plentiful resources.

Noise

The market itself will also serve as a source of information for investors to understand what impact likely maximizes the compromise morality. Investors who correctly identified highly uncontroversially valuable impact early on may sell to take profit, manage their risk, or pay their rent – reasons other than thinking that the impact is overvalued – but this sell may be misinterpreted by others as a signal that the impact was more controversial than they had thought. All of this introduces a lot of noise that distracts from the price discovery. This is something that happens on financial markets all the time, and public companies have to be sophisticated enough in their budgeting not to be ruined by fluctuations that have nothing to do with their fundamentals.

Sophisticated funders who are highly confident in their judgment, or more so than other market participants, can stabilize the prices by buying, holding, and dedicating impact certificates, but they can do so only to the extent that their budgets allow.

This is more of an inefficiency than a risk of net harm, so we’re less worried about it than about the above.

Solutions

(We briefly covered this section in our talk at Funding the Commons II.)

Curation

There are three forms of curation:

Curation of each impact certificate that is submitted to the marketplace.

Curation of the issuers who are allowed to submit to the marketplace.

Curation of the investors and retro funders who are permitted to use the marketplace.

These can be performed by a team of expert curators, by some sort of oracle, or by an auditor network (see below). Exposé certificates and shorting (see below) can help the curation team not miss any bad certificates.

The first method can be aided by limiting the market to a particular topic. If only AI safety research is allowed to be sold on the market at all, then it already excludes a lot of dangerous categories of things, such as terrorist attacks, and the curation team does not need to contain experts from more than one field.

The second and third can be based on the implicit web of trust that emerges when people are only allow to apply for access to the platform if they were recommended by existing users of the platform. The application process could include courses and quizzes if the platform is valuable enough for the users.

Impact Attribution Norm (formerly “Attributed Impact”)

We think it will be key to find a definition of impact that has four properties:

It leads investors to value impact in proportion to the moral gains from trade that it has generated,

It leads investors to value impact in accordance with some form of idealized rather than revealed preferences of all affected groups,

It forms an attractor state so that over time more investors tend to adopt the definition (be it unconsciously) rather than fewer, and

It tracks but makes more precise the existing shared intuition of what “someone’s impact” is.

The following definition is an attempt at that. It relies on a lot of culturally shared understanding, which is hopefully also shared to a sufficient degree between investors. Enforcing honesty or detecting lying of market participants is outside the scope of the definition.

It boils down to something like, “Your impact must be widely regarded as morally good, positive-sum, and non-risky before and after you undertake your action for it to be valued at a positive price.”

Definition

Impact Attribution Norm (v0.3):

We define impact as the gains from moral trade achieved by a set of actions.

We take into account the interests of all moral patients, regardless of time, location, species, substrate, gender, phenotype, orientation, market participation, etc.

Specifically, we value actions positively only if they were robustly positive in anticipation.

We attribute impact to all those actors whose actions make them responsible for the impact.

We draw on widely accepted cultural norms guiding responsibility.

We assess impact as compared to counterfactual world histories that seem ordinary by broad societal standards.

In particular we do not rely on counterfactuals that are easily influenced or merely claimed by the issuer.

We leave it to the actors to make a case for the value of their impact.

Where we have to make judgment calls on behalf of others we will assume that they favor noncausal decision theories and the Kalai bargaining solution.

In Plain Terms

As issuer of an impact certificate:

You need to make a case that the actions you’re planning to take will generate robustly positive impact. (You should reference the particular version of the definition that you’re using.)

You cannot just pick one metric or moral dimension along which you want your impact to be measured. You need to make the argument that your action is good or neutral across all moral views and interests, that harms are offset in ways the participants would accept, or something along those lines. In short, an’ it harm none, do what ye will. (Slight oversimplification.)

In particular, you need to argue that at this time (when you haven’t taken the actions yet) it is reasonable for the median market participant to think that your action will generate impact in expectation. This should be positive impact unless you’re happy that your impact certificate will have negative value and no one will buy it.

Note that you can’t inflate your impact by claiming that something unusually terrible would’ve happened if you hadn’t performed your action. If such a claim is not plausible to someone like Erin McKean, or anyone else who doesn’t know and knows nothing about you, then it doesn’t count.

Note also that you can’t lie about your actions. If you write an impact certificate for one action and then then perform a different action, the impact certificate is for an action that didn’t happen and there is no impact certificate for the action that you did do.

Finally, talk to others who you are bargaining with if at all possible. If not, please don’t automatically assume that they make decisions according to CDT, and if you’re unsure about what bargaining solution they’ll favor, go for Kalai.

Commentary

Gains from moral trade. The reference to the “gains from moral trade” codifies that what makes an action valuable are not its effects along some arbitrary moral dimension but all moral dimensions, and in particular the improvement that the action achieves over a hypothetical completely disjoined state of the world where everyone is on their own.

There is the degenerate case of an action that benefits one moral view and is irrelevant for all others. Such actions might as well be valued positively, because why not, and we would welcome an elegant way of fitting them into this framework, but they are probably quite rare or small scale, so that they don’t matter much in the scheme of things. Maybe we can imagine that in such cases there is a being that gives you something that neither of you value or disvalue in return for you looking after your own moral interests.

This exclusive focus on the gains from moral trade has a host of related advantages: Investments into zero-sum games will have no value on a certificate market, except insofar as they generate net positive externalities; projects that defect against some future beings for the benefit of others are penalized; progress on some values that is offset by harm to other values is without value; projects are incentivized to seek out new moral dimensions orthogonal to all known ones; and projects are encouraged to do cross-cutting work that benefits a variety of moral systems.

The subitems clarify some assumptions. In particular, the category of moral patients is supposed to be interpreted maximally widely. You can’t just avoid defecting against someone by declaring them not a moral patient. When it doubt, these rules should be interpreted so to err on the side of caution and inclusion in the set of moral patients.

Responsibility for the impact. Especially the term “responsibility” is one that relies on a culturally shared understanding, ideally one codified in law or a contract. We see no objective way to attribute impact other than by convention. Here the burden of proof is upon the person who makes the claim.

Counterfactual world histories. This clause prevents issuers from manipulating the default as described above.

Changes in the supplies of goods need to be assessed against some counterfactual, and in this case we want to use a counterfactual that everyone can know and that is very hard to influence by any one actor. We might call this perspective the systemic stance, in reference to Dennett’s intentional stance and system science, which is a perspective that abstracts from agents and intentions to recognize systemic or emergent mechanisms. It’s a form of underfitting or dimensionality reduction. As a result, an attacker would now have to change large swaths of society into one that regularly conducts flash loan attacks (per the example above) before their omissions to do so becomes different from the default.

Retro funders need to proactively signal their adherence to the norm to make it clear to any potential attackers that they are not vulnerable to this exploit.

A disclaimer, in case you now think we hate historians: We compare full world histories (unless the impact period is explicitly curtailed in the certificate), so not only the time between the decision to implement the project and the present moment or any other such period. But this is done in the spirit of a belief that the Tickle Defense is probably true. So a person who surprisingly kills someone produces evidence that people sufficiently like them have killed people before and thus narrows the set of subjectively plausible pasts to a set of worse pasts, but a historian who researches past killings has not the same evidential effect because the killings they research screen off any evidential effect the historian has. The spirit of our definition is that if the Tickle Defense fails, we want to correct our definition and not put blame on historians!

The sets of world histories all contain several pasts, presents, and futures, because the issuer had uncertainty over past, present, and future at the time of the decision. (In view of the many-worlds interpretation, we intend “world histories” to include all Everett branches weighed by their measures.)

Make a case. Every issuer has to make the case that their action conforms to the norms. This should not be left only to the retro funders to figure out. The retro funders’ job is rather to find weaknesses in the case. If every impact certificate thus recapitulates the definition, it will gradually become reified culturally as the consensus definition of the Impact Attribution Norm. We call this a “driver of adoption.” The Impact Attribution Norm contains several for redundancy.

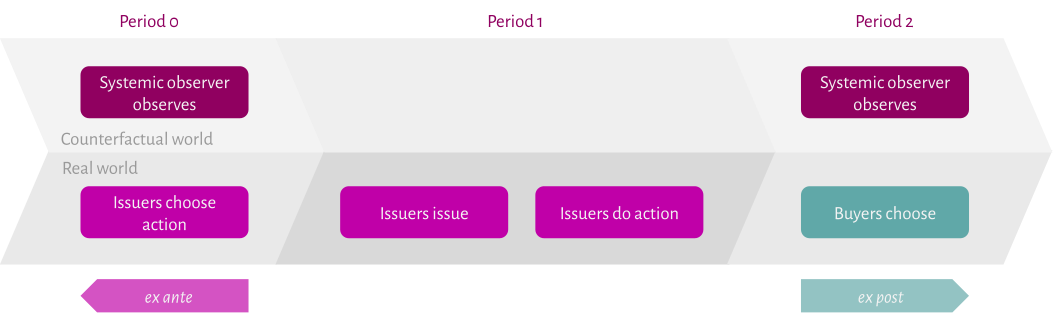

The norm follows (in spirit) the JTB definition of knowledge as a justified, true belief. In the impact certificate or some ancillary document, the issuers justify their claim to the Impact Attribution Norm by laying out how they think the reader ought to arrive at the conclusion that they were, at the time of the decision, justified to believe that what they did would generate positive impact. Time and the market then arbitrate the question of truth. Only if ex ante and ex post impact are positive is the aggregate impact (the minimum) positive.

This avoids the pathological case of x-/s-risk gambles where someone runs a large number of very risky projects – projects that can turn out vastly net positive or net negative – and then makes money by selling only the impact from those that happened to turn out positive even if they are in the minority. (Or likewise for funders.) Those that happened to turn out positive would still not be worth anything because their 0 or negative ex ante impact will be less than the positive ex post impact, so that the positive impact will have no influence on the eventual value. This mirrors the intuition between expectational consequentialism where, for example, a doctor who treats a mild headache with a medicine that is 99% likely to kill the patient acts immorally even if the patient actually happens to survive and be cured of the mild headache.

Note that this applies in the same way to the anthropic formulation of the x-/s-risk gamble where issuers or investors believe that (1) they hardly affect the odds of extinction, for example because of market efficiency, and (2) they are neutral about x-/s-risk futures because they can’t spend money anyway if they’re dead or otherwise incapacitated but they do care about the okay outcomes where they can spend money.

Aside. The similarity to the JTB definition suggests that the Gettier problem may be a problem. But we haven’t managed to construct an actual pathological or exploitable version of it. (You can skip to the next subsection if you’re in a hurry.)

An example: Aanya Altruist reviews some 450+ studies and concludes that there is strong evidence that the serotonin transporter gene 5-HTTLPR is associated with depression. She develops and promotes a school-based screening procedure that provides people with the particular versions of 5-HTTLPR with resources on how to access therapy. Biology teachers love the program for how helpful and scientific it is. Aanya makes a case for her impact and sells it. Then it turns out that (1) 5-HTTLPR has nothing to do with depression, and (2) many of the children who had received the resources had become depressed at the population base rate but started therapy at a much higher rate.

Aanya Altruist’s defense of her impact is state of the art by the standards of her field at the time, and she is honest about believing her conclusions. Yet they turn out to be false. So her impact is valuable by dint of her earnest, justified intentions and by dint of her quite unrelated impact. This is probably not going to be a common case, because we expect there to be few impactful interventions so that few people will find them by accident, but it doesn’t seem harmful either.

But the system is hypothetically exploitable in another way: Someone may find a new, previously unknown CO2 sink that they predict to start absorbing CO2 within a few years. They build a complex contraption that no one understands but that is just plausible enough that they can fool investors with an amphigorical justification. Then they start it right when the natural CO2 sink goes into action. Finally they claim credit for the impact.

Another variation of the theme: Someone builds in secret a lot of machines with fairly general seeming purpose but without actual function. Then they wait for a near catastrophes. Maybe there’s a hurricane that changed course just before it hit the shore. They reveal one of the machines that happened to be nearby and claim to have used the hurricane as a beta test for the hurricane-averting machine and sell the impact from it.

Maybe people will come up with more realistic variations on this theme. When that happens, the problem can probably be addressed through preregistration of impact certificates and buyers penalizing any lack of preregistration. (Preregistration may be as simple as issuing an impact certificate before the impact has happened, which should be the norm anyway.)

Noncausal decision theory and Kalai bargaining solution. There is a risk that people will default to assuming that other market participants are causal decision theorists. This would preclude gain from acausal moral trade. We’re unsure what decision theory is best to recommend here, but it is probably not causal decision theory. The bargaining solution is also something we’re unsure about. We don’t know which bargaining solution to pick here, but not specifying any seems worse than specifying a random one. Resource monotonicity seems to us like an important criterion for the general acceptability of a bargaining solution in a rapidly growing market (the Nash bargaining solution doesn’t ensure it), maybe more so than scale invariance (the weak point of the Kalai one). Independence of irrelevant alternatives seems superficially important to us (the Kalai-Smorodinsky solution doesn’t ensure it), but we haven’t thought about this in detail and would greatly appreciate feedback on this decision.

Summary. This definition of the Impact Attribution Norm addresses (hopefully successfully) the following problems:

Impact is not naturally uniquely owned. It addresses this by relying on cultural norms and laws around responsibility, such as legal ownership, authorship, etc.

Issuers may generate one good at the expense of another. This is addressed by tying the evaluation to an aggregate of all public goods.

Markets incentivize risky gambles. It addresses this by defining the Impact Attribution Norm as the minimum of ex ante and ex post expected impact.

Counterfactuals are impossible and arbitrary. This is addressed by stipulating a particular way of thinking about the counterfactuals that relies on the subjective expectation at two points in time of an observer that knows no specifics about the case.

Buyers are vulnerable to extortion. This is addressed by stipulating a counterfactual (see above) that is very hard for an individual to influence.

This definition may be ignored. It addresses this by asking issuers to defend their impact in terms of the definition and by protecting buyers from extortion if they proactively signal adherence to the definition.

Timeline

This is a sample timeline of how an issuer may produce impact. Period 1 is when the impact is issued and generated, in whatever order. Period 1 separates Period 0, where the real and the counterfactual worlds haven’t diverged, from Period 2, where they have diverged and continue to diverge.

On both sides of Period 1 there is one systemic observer, who is imagined/simulated by the investors. In Period 2 there is also the actual investor. (We’ll use simulate over imagine to convey that the goal of the mental simulation is accurate prediction and not, say, entertainment.)

So this is what happens in temporal order:

The prospective issuers consider that a systemic observer would typically expect people like them to do stuff. So they surmise that future buyers would also agree that a systemic observer would expect that. But if they did a thing instead, a systemic observer would be surprised.

The prospective issuers iterate through a few options for things to do, and eventually settle on one. That thing is a great thing because it generates morally relevant preference satisfaction for some beings without undermining the preference satisfaction of others. They implement it and document it in an impact certificate alongside a lengthy defense.

A month has passed and a few buyers get interested in the impact certificate.

They by and large agree with the issuers on the expectation of the systemic observer in Period 0. This systemic observer is virtually the same as the one in Period 2. They imagine themselves in the shoes of the issuers in Period 0, and find that they might have predicted a few additional benefits and drawbacks but nothing substantial, and agree with those that the issuers have documented in the impact certificate, and with their conclusion that the thing appears like it would be net positive in expectation.

Then they return into their own shoes where they have the invaluable benefit of hindsight. From this vantage point they realize that a few of the drawbacks they were retroactively worried about had not manifested but that some of the best-case scenarios have also become less likely. All in all, the thing still appears to be net positive in expectation, now with slightly reduced variance. They can’t quite tell which expectation, ex ante or ex post, is lower, but they think that both are positive and fairly close together, so they don’t care much and just bid on the impact certificate according to their budgets.

Note that strictly speaking the buyers also simulate the issuers because the certificate will be phrased in natural language which is highly ambiguous without knowledge of the (likely) intent of the author. We’ll omit this simulation in the graphs since it’s quite intuitive.

That’s all a bit of a simplification because many prospective buyers (let’s call them investors) want to make a profit. So they’ll perform further evaluations to understand whether they may know more or have more accurate information about the real expected impact than other investors and whether the other investors will attain that knowledge too, be it automatically over time or through a publication by other investors. Occasionally they may also seek to prove that the issuer had private information already in Period 0, which they pretended not to have, or conversely, whether something that is widely assumed to have been known at the time actually wasn’t knowable.

Example

Example. The issuer has sold 500 pins with cute designs and animal rights messages on them at a convention. They’ve donated the proceeds to an animal rights charity. They now sell the impact from this action.

The issuer thinks that the donation of the proceeds is the main driver of the positive impact, so the certificate text focuses on the money.

But one investor thinks that most investors are unexcited by the donation because they think it just displaces donations from corporate partners of the charity who don’t have set CSR budgets.

This one investor thinks that most investors think that reaching 500 people with the animal rights messaging is the main driver of the impact, in particular because the designs were actually created by well-known members of the community that the issuer sold the pins to, something that is widely known but that the issuer didn’t mention.

But this one investor also freshly found photos from the convention and noticed that the issuer had sold five different designs, and that, in group shots, a lot of people could be seen wearing multiple or even all five pins. The investor shorts the certificate before announcing their finding because they expect that the issuer had reached much fewer than 500 people.

This example aims to clarify that:

Issuers and investors can disagree on the path to impact, yet it can still be valuable ex ante and ex post.

The certificate description is never going to describe reality fully (and critical omissions can be unintentional), so it should contain as much information as possible that will help buyers do their own research to fill in gaps – such as finding photos from the convention.

The issuers and all investors can have different ideas of the actual and the counterfactual world histories from the perspective of the systemic observer.

Only when an investor can anticipate a price-relevant update of some of the other investors can they make money. If an investor knows more than the others but has no way of convincing them, they can’t scoop them. (But in this case they could because they had photographic evidence.)

Pricing Impact

Attribute Impact itself has no particular unit. One could pick a benchmark project – such as $1 distributed through GiveDirectly – and measure projects in relation to it, but we have not attempted this.